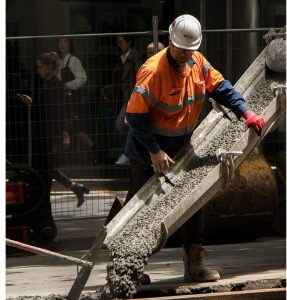

Different occupation groups can claim different tax deductions. In this article we’re putting the spotlight on concreters and highlight what they can claim as business expenses.

Different occupation groups can claim different tax deductions. In this article we’re putting the spotlight on concreters and highlight what they can claim as business expenses.

Typical tax deductions for concreters include:

- Motor vehicle travel to and from work if having either shifting workplaces (working at more than one site each day before returning home), or transporting bulky equipment.

- Motor vehicle travel between job sites, to pick up materials, or attending training courses.

Computers, tools and equipment. - Phone and internet – work %.

- Dogs, when used at worksites to guard tools against theft. The purchase cost of the dog and training fees are not deductible as they are capital costs. In contrast, vet bills and pet food bills may qualify as a tax deduction.

- Overnight travel expenses when visiting clients or attending different workplaces – includes meals and accommodation.

- Protective clothing including sun-protection clothing, safety-coloured vests, steel-capped boots, gloves, overalls, and wet weather gear.

- Overtime meals – if overtime meal allowance received under an industrial award.

- Sun protection costs including sunglasses and sunscreen.

- Union fees, licences, registrations and subscriptions.

- Courses, seminars and self-education expenses.

- Home office running expenses.

If you’re unsure about what you can claim as a tax deduction for your concreting business contact us now for a FREE Tax Deductibles Check.

Free Reports Reveal

How To Stay One Step Ahead of Your Competition and If You Have Chosen the Right Business Structure, plus more…

Please Note: Many of the comments in this article are general in nature and anyone intending to apply the information to practical circumstances should seek professional advice to independently verify their interpretation and the information’s applicability to their particular circumstances.